Buy and Sell Websites – Online Investing Explained: Part I

This is the first part of our (very) comprehensive guide to Buying and Selling Websites. If you’re done with Part 1, I highly recommend you check out Part 2 as well. You can access Part 2 of the guide here.

Why Buy Websites?

You might be wondering “Why shouldn’t I just put all my money into a retirement account? Why invest in web properties at all?”

The truth is, in today’s world, working the same job for 40 years and dumping all your money into a retirement account is no longer an option. The majority of new retirees are finding that they simply don’t have enough saved up to live comfortably, and the situation is only going to get worse..

Nowadays, working hard at a job for a few decades is no longer enough to guarantee financial security, let alone financial freedom. You need to take control of your own financial future right now.

Traditional investments like stocks and bonds are great if you’re already wealthy – but the truth is, these traditional investment options are rigged in favor of the powerful. If you’re participating in traditional financial markets, you’re competing directly with the big banks and wealthy insiders – you only need to think back to what happened in 2008 to realize that the financial markets are rigged against regular folk.

Luckily, there are still ways for you to ensure your own financial security. The Web Property market as it stands today is still relatively unstructured – and that means that you’re not competing against the Financial Titans of the world. It’s a vast, untapped market, and if you invest your capital wisely, the returns can be truly extraordinary.

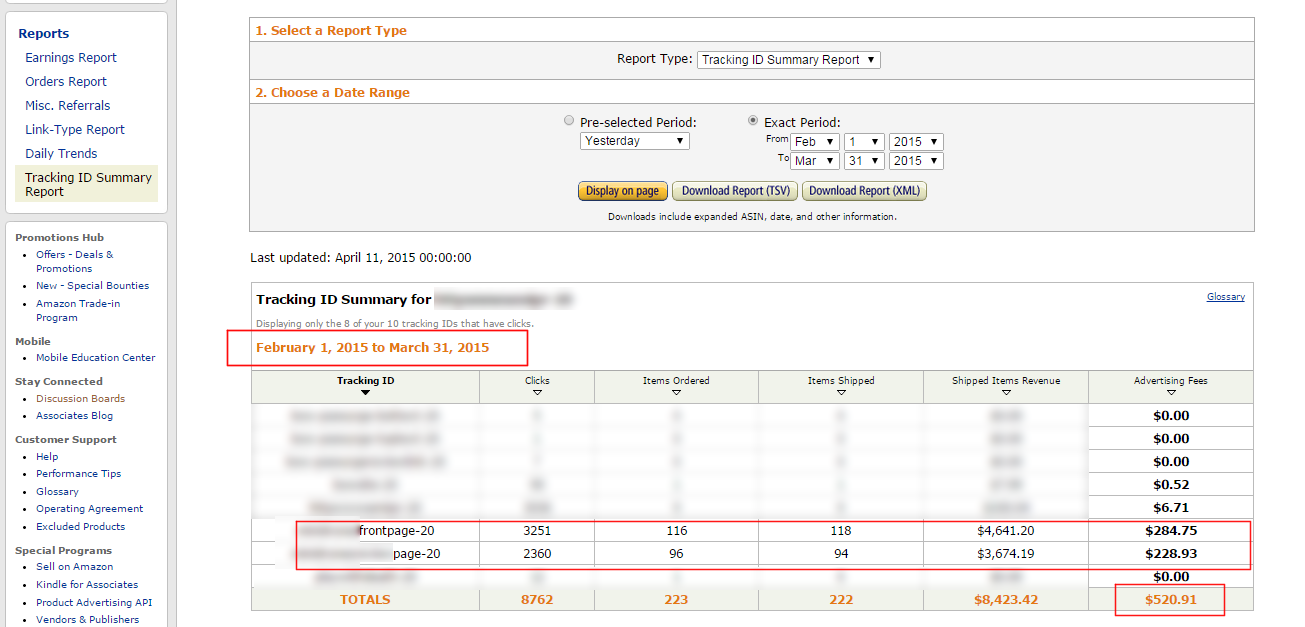

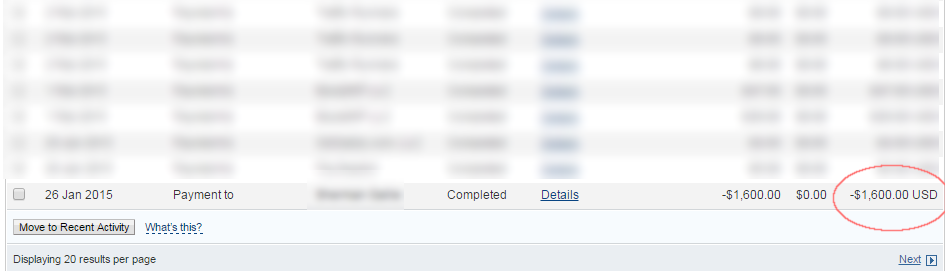

Let me give you an example – I recently bought an Amazon Affiliate site for $1600. In the first two months after the purchase, I made $500 in affiliate commissions. That translates to an annual return of close to 200%. Compare this to the average return expected from an investment into the stock market – the very best professional investors consider a return of 20% to be outstanding. We detailed the comparison between Web Investing and traditional investments in greater depth on our About page.

Here are my Amazon earnings for the two months after purchase. Only include the results highlighted by the red boxes.

Now, there are some downsides to website investing. The market right now is kind of like the Wild West- it’s undiscovered and unsettled. If you invest your capital wisely, there’s a chance that you could drastically improve your level of financial freedom. On the other hand, if you invest recklessly, you’ll find that the Wild West of Website Investing to be a wholly inhospitable place.

There are scams everywhere – especially on the lower tier of web properties. Luckily, the vast majority of these scams are easy to avoid if you know what to look for.

Due diligence is the most important skill when it comes to investing in web properties. If you don’t have the patience to read through this guide and at least learn the basics of proper website due diligence, then you probably shouldn’t pursue website investing at all.

Where Do I Buy Websites?

There are a number of places where you can buy websites and web properties. On the lower end, there are a few free-for-all marketplaces where it’s possible to get great bargains if you know what to look for. On the other hand, these marketplaces also tend to be rife with scams. If you’re thinking about buying a site on a marketplace, just remember- if it’s too good to be true, it probably is.

The next step up from the marketplaces are low-end brokers. Low end brokers will do some basic due diligence, and they generally work on behalf of the sellers. These brokers tend to sell sites from about $5k upwards (although there are a few exceptions) and generally speaking, brokered sites sell at around 20x monthly earnings (so a site making $100 a month will go for $2K on average).

Then there are the high end brokers. These are basically website brokers who cater largely to wealthy sellers and investors, and sites that end up getting sold by high-touch brokers typically sell for at least $50K. The deals that occur with these types of brokers can go into the millions, and the web properties that change hand in these circumstances are typically ‘real businesses’ that sell a product or service.

Even if you’re wealthy, we’d urge you to stay away from working with the high-end brokers until you’ve familiarized yourself with some of the fundamental concepts relating to online business.

Marketplaces

Flippa: The most well known and most popular website marketplace. Many scams, but also a place where you can find diamonds in the rough if you know what you’re doing. The high number of scammy listings pulls prices down across the board.

Digital Point Forum Marketplace: Quality on this forum varies greatly – less structured than Flippa, but some sellers prefer listing here to avoid the high fees that Flippa charges.

WebsiteBroker: Lesser known alternative to Flippa. Contains some higher end listings as well.

Low End Brokers

Empire Flippers: The most well known lower end website broker. The sites listed here have generally been vetted already, and while due diligence is still required, the listings are unlikely to be outright scams. Sites are listed at 20x earnings, but some negotiation is allowed.

Flippa Dealflow: Flippa Dealflow is separated from the marketplace itself, and if you use this service, you’ll get a dedicated broker who will walk you through the process. Mainly used for sites that will sell for $20K+

FE International: A touch higher-end that the two previous brokers. FE international typically brokers sites that are valued at $30K+.

High End Brokers

We honestly haven’t had the pleasure of working with any high end brokers yet, so we don’t have any comments on them, but the following are three more well known high end brokers.

The Buying Process – Due Diligence and Valuation

I can’t stress this enough. The most important skill when it comes to investing in web properties is due diligence. If you don’t do proper due diligence, it is exceedingly likely that you will lose money.

To do proper due diligence, you have to first understand the things that make a website valuable.

Valuation Factors

Earnings

At the end of the day, your goal when investing a website is to make a return on your money. The surest way to guarantee a good ROI is to buy a site that is already profitable. Also, you should know that some sites are very seasonal – a site about costumes will typically earn the most just before Halloween. You should always consider seasonality when you’re judging earnings.

Traffic

Generally speaking, the more traffic a site gets, the better. It’s also important to consider the type of traffic that a site gets. For example, if the site you’re looking at makes affiliate income from selling golf clubs on Amazon, you want visitors who are interested in golf. The quality of traffic is sometimes more important than the quantity of traffic.

Monetization method

What is the source of income of the site? Some sites use monetization methods that are more labor intensive – a site that sells writing services will require the owner to find and work with a freelancer, which takes time. Also, some monetization methods are less reliable than others. Google Adsense and Amazon Affiliates are reliable – they pay on time, and they’re not going to go out of business.

If a site is an affiliate of a niche specific ecommerce store, there’s always a chance that that the owners of the store won’t payout, or that the store will close. On the other hand, large ad/affiliate networks tend to pay out less on average.

Conversions

Some sites convert extremely well, whereas others convert extremely poorly. You might think that you’d clearly prefer a site that converts well, but that may not be the case. A site with a poor conversion rate has potential to be improved quickly, which means that you may be able to get good value for the site, especially if you’re good at CRO (conversion rate optimization). On the other hand, if you’re confident you can increase traffic to a site, then you might prefer a site with less traffic that converts well already.

Domain Value

Sometimes, a site can derive value purely from its domain name. This can work in two ways. The first is that the domain itself worth something. For example, if you bought a site about the New York Subway with the domain “subway.com”, it’s likely that the domain itself would be worth something to Subway (the sandwich company). While this happens sometimes, it’s normally not a big factor when you’re buying a website.

The other, more relevant source of domain value is the links that a domain has. A website that has a domain with many strong links pointing to it will rank more quickly in search engines when new content is released. Many people use the “Trust Flow” metric from Majestic.com or “Domain Authority” from Moz.com to judge the value of a domain. We will delve more into these metrics in the due diligence section.

Content Value

People often overlook the value of content when it comes to judging the value of a website. On a fundamental level, content is valuable because producing new content takes time and/or money. Quality of content is also important – in the long run, sites that have well written, useful content will outlast sites that don’t.

The quantity and quality of content has an effect on all aspects of a website’s value. It’s easier to get other websites to link to high quality, informative content (and links help with SEO and drive traffic), and useful and engaging content tends to also lead to higher conversions (people are more likely to trust websites that have great content).

Traffic Diversity

You should also take into account the source of a website’s traffic. Some people like the idea of diversified traffic – a site with varied traffic sources won’t be crippled even if one source suddenly collapses. On the other hand, you should also think about what your strengths are. If you don’t know anything about Pinterest, then you probably shouldn’t buy a site that relies heavily on traffic from Pinterest because you might not be able to maintain that traffic source.

Most people have a preferred way of generating traffic to their sites, but its also good to remember that a little traffic diversity can make a site more sustainable in the long run.

Growth Potential

I have this last on the list because for a beginner, it’s probably the toughest factor to evaluate. That being said, you should always think about the ways that you would try to improve a site when you’re evaluating it. Can you improve the on-page SEO optimization? Do you have a great way to build new links to a site? Are there more profitable monetization methods? You should be asking yourself these questions before you make the decision to buy.

While potential is great, it’s generally not something that a prudent investor is willing to pay for. You should definitely consider the growth potential of a site before buying – but by the same token, you should never buy a site based on it’s potential alone. The potential for growth should at most be the icing – never mistake it for the cake itself.

Due Diligence

When you’re looking through possible sites to buy, you’ll find that the listings will often include traffic and earnings numbers, and perhaps some other relevant information too. Basically, the seller is making certain claims about the website he’s selling. If you’re interested in buying a site, your first goal is to verify that the traffic/revenue claims made by the seller are broadly true.

When doing due diligence, it is important to go in with the right mindset. When doing DD, your goal is to find a reason to say ‘No’ to any given investment. You should always try to err on the side of caution. If you go in thinking that your goal is to reach a ‘Yes’, chances are you’ll eventually end up talking yourself into a bad deal. Also, you should always ask a lot of questions. Typically, a scammer will get defensively almost immediately when you ask perfectly legitimate questions, whereas legitimate sellers will normally be very willing to provide you with answers.

Verifying Traffic

The first thing you’ll want to verify is traffic claims. Regardless of whether you’re buying through a broker or buying on a marketplace, it is pretty customary to ask for Google Analytics access. Occasionally you’ll come across a seller that uses Clicky. Either way, both analytics systems allow for guests to view the data. If a seller tells you that he can’t provide access to his analytics, you should walk away immediately. Also, if a seller says that he ‘Just added Analytics’, that’s also another red flag because it stops you from being able to see the historical data.

Once you get access to analytics, the first thing you’ll want to look at is the sources of traffic. Traffic is extremely easy to fake. The key to differentiating fake traffic from real traffic is to look for consistency.

For example – if you see that the site gets a lot of organic search traffic, you should try and find out if its ranking for any keywords. You can use the SEMRush toolbar for this – or alternately, you can check manually by going to Behavior–>Overview and checking which page is most popular. Then go to that page, try to work out what KW it targets, and search for that KW in Google (in incognito mode, using the correct location in Google Advanced Search).

If the site gets mostly social traffic, check out the site’s social pages. Does the Facebook page have a lot of likes? A popular FB page that drives real traffic will normally have a good number of comments under each post. If FB is a large source of traffic for the site, an FB page with a ton of likes but no user engagement in the form of comments/likes on individual posts should be a warning flag.

The same goes with other social networks – a Pinterest page with a ton of followers but no repins is unusual. If a site has a a lot of traffic from reddit, you should know that reddit traffic tends to die out pretty quickly. Get to know the basics of the more popular social networks and you’ll be able to quickly tell if the social traffic on a site is plausible or not.

Here are some other traffic related red flags:

- The site is in English, but a lot of traffic comes from non English speaking countries.

- A majority of the traffic comes from a one or two cities (and the site is not specifically targeted to those cities).

- A large amount of traffic comes from users who use the same technology (e.g a majority of users run Windows and use 1024×768 screen resolution)

- The users on the site disproportionately share certain characteristics (for example, 80% of the site’s traffic uses Internet Explorer, when only 25% of all internet users actually use IE.)

- Unusually high/low Bounce Rates or Time On Site that don’t make sense in the context of the site.

- A large amount of direct traffic (people typing the site name into the browser) that doesn’t make sense in context.

- Majority of the traffic comes from users on the same ISP

Also, ask a lot of questions.If a site gets organic traffic, ask the seller for the KWs it ranks for. If a site gets a ton of social traffic, ask him how he built up such large social followings. The more questions you ask, the more likely you’ll get an answer that doesn’t make sense – and answers that don’t make sense are a great way to tell a scam from the real thing.

Verifying Earnings

The best way to verify earnings is to set up a screen-sharing session with the seller – especially if earnings aren’t verified by the Broker/on Flippa. That being said, not all sellers are enthusiastic about screen sharing – this should serve as a warning flag but it may not be a dealbreaker.

There are other ways to verify earnings. A lot of it is common sense. If a seller claims that a site earns $100 a month on Adsense, you can check the CPC of the niche, make an educated guess at a Click-Through-Rate (typically, for Adsense, the CTR is about 1-2%). Then you can work out if $100 makes sense with the following formula:

Total Traffic x Conversion % = Ad Clicks. Ad Clicks x Niche CPC = Approximate Adsense Earnings.

You can also try to catch a seller out by first asking for his conversion %, then wait a few days and ask what his CPC is. Scammers will sometimes forget that you asked for the conversion % previously, and you can see if his figures add up or not.

The same principles applies to Affiliate earnings. Take an educated guess at the conversion %, find out how much commission the site gets on the affiliate network, and see if the numbers make sense. Ask the seller what product sells the most, wait a couple of days and ask what his conversion %s are. Amazon commissions normally range from 4% and 8%, so take the midway point of 6% and see if the claimed earnings are anywhere near your educated guess at the earnings.

Another way to catch potential scammers is to ask to add them on Skype, then ask them to send you a screenshot of their Amazon Earnings. Typically they’ll send you the Earnings Report page – immediately after they reply you, ask to get a screenshot of the ‘Orders Report’ – and tell them you’d like to see it right now. If the Earnings Report is doctored, they may not have time to fake an Order Report screenshot on the fly. If they leave you waiting for a while, that’s a clue that a screenshot might be Photoshopped.

Also, while this is exactly due diligence, you should make sure that you can access the same monetization methods that the seller is using, especially if it’s something you’re not familiar with. If the site uses lesser known affiliates or ad networks, ask the seller how to apply, how difficult/complicated it is, and whether he/she can help you with the getting the monetization set up properly if you decide to buy the site.

Checking the Backlink Profile

This step is particularly important if a site you’re looking at relies heavily on organic search engine traffic. A site receives organic traffic because it ranks in Google (or other search engines). A site normally ranks in Google because it has a backlinks from other websites. You need to check whether the backlink profile of the site is healthy or not.

The best kind of backlink profile is one that has links from a lot of authority sites (e.g Wikipedia, BBC, Techcrunch etc), but relatively few websites are lucky enough to have collected a bunch of links from a lot of these kinds of sites.

What you want to find out is:

1. How were the backlinks built?

2. How risky is the backlink profile?

3. How relevant is the backlink profile?

4. Does the seller control the links that point to the site, and will he remove them as soon as he sells the site?

We don’t really have the space to delve into the minutiae of back-link analysis here, but here are a few rules of thumb:

- If a site has a lot of foreign backlinks, that may be an issue

- If a site has a lot of links from seemingly irrelevant sites, the links may be part of a Private Blog Network. Ask the seller about this.

- If the links have higher than 5% Exact Keyword Anchor Text (e.g the site is about Golf and more than 5% of the links have the anchor text “Best Golf Club”), the backlink profile might be risky. Generally, what you want to see is most of the anchor text to be either generic (“click here”, “this article”), branded (Joe’s Golfomania) or naked URL (www.joesgolfomania.com).

- If the majority of the sites links are generic directory links, or comment links, or press release links, that’s a warning flag.

- You can use Majestic Trust Flow (difficult to manipulate) or Moz Domain Authority (easy to manipulate) as indicators of the strength and the health of a site’s backlink profile.

Basically, if you see anything weird about the backlink profile, you should pester the seller with questions. How did he get these links? Did he buy or rent them? Does he own the sites that link to the site he’s selling? Did he use spammy software to build the links?

When it comes to backlinks, you really need to be the judge. In some cases, sites can rank for a long time, even off of a spammy/poor backlink profile. But if you want to avoid the possibility of a site getting crushed by a penalty or something similar, then you should check the backlink profile carefully and be aware of any red flags. Basically, you should try and understand that some types of backlink profiles are riskier than others – then you need to decide for yourself whether or not you’r

e happy to take on that level risk or not.

Checking the Content

This part is pretty basic. The first thing you want to be sure of is that the site does not contain duplicate content. You can do this using Copyscape – it’s relatively cheap and works well for this purpose. Take paragraphs of content from the site and dump them into Copyscape to see if there is any similar content on the web.

You should also think about whether or not the quality of the content matches up with the other claims of the site. If a site is poorly written, you would expect a high bounce rate and low time on site. If a site is badly designed, and only has one small affiliate link at the bottom of a page, a high conversion rate on that product would be suspicious. A site with reviews of Shredders would be unlikely to get a ton of traction on social media.

Due Diligence Conclusion

Basically, doing proper due diligence is all about consistency. Think of yourself as a detective – your goal is to find holes in a website’s ‘story’. To be able to do that well, you’ll need to learn the basics of each aspect of a website. Never shy away from asking a question, and always be on the lookout for numbers that don’t add up or things that don’t make sense. A lot of the scams are reasonably easy to spot once you’ve had the opportunity to examine a few websites.

Also, remember that this is only half of the guide. You can check out Part 2 of the Guide Here – in Part 2, we cover the following:

- Valuation

- The Transaction Process

- Improving your Site’s ROI

- Whether or Not You should Sell

- Where to Sell

Fantastic part 1 guys. Looking forward t reading part 2.

Buying website properties to me always seems frought with difficulties, but I suppose navigating through the potential pitfalls is why is still offers great ROI in the end.

Do you intend to cover the ‘transfer of files’ process when you buy or sell a website?

Hi beautiful white kitchens (I’m betting that’s not your real name),

Buying websites is definitely difficult, but yea, it can be pretty rewarding if done correctly.

We don’t intend to cover transfer of files in the case study since Spencer is still a silent partner. However, it’s very likely that I’ll cover that topic on this blog at some point, so stay tuned!

Thanks,

George