How to Find Established Sites For Sale (That Rock) – Live Case Study Part 1

Today’s post is the first part of a live case study. I’m currently looking for a new website to buy. I’m going to do a live case study where I browse through Flippa listings, and I’ll simultaneously record down my thoughts on the various sites that I look at. My goal is obviously to find a web property that I’m interested in bidding on (or at least interested in finding out more about) – but since it’s a live case study, there’s no guarantee that I’ll find anything good. Think of this as the opposite of our previous article, The Anatomy of a Flippa Scam.

The importance thing is to focus on the process – now, I’m by no means the most experienced website investor out there, but I do believe that by going through sites one by one and detailing my process as I do so, I’ll be able to provide some useful insight for those of you who are less experienced.

So, today I’m going to be using Flippa (just because a lot of data is easily available on Flippa – brokers sometimes don’t release domain names of the sites they’re selling unless you pay a deposit, which doesn’t suit the purposes of this case study).

The first thing I do when I’m of the Flippa site is I click on Established Sites – you can go with Most Active or Reserve Met here. The other categories aren’t all that useful. Most of the time I like to go with Reserve Met because I don’t want to waste time looking at anything where bidding is a waste of time because the high bid isn’t anywhere near the Reserve price set by the seller. For today’s exercise however, I’ll go for Reserve Met.

I’m going to filter the results with the following:

Verified Analytics (I don’t really want to bother with any sites that don’t have Google Analytics)

Auctions Only (I don’t want to submit offers to sites that previously failed to sale at auction)

Domain Age >= 6 months (I don’t want to look at any sites that are brand new, many of these have really unrealistic claims about traffic)

Flippa returns 22 results to me.

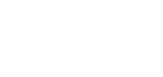

I took a screenshot of the listings that I currently see on Flippa:

Out of the 22 listings, I can rule out at least 6 because they are actually not on Auction (the last 6). Not sure why this is, since I filtered by Auction Only already.

Browsing Through Website Listing

TuningCult.com: Potentially looks interesting. A reasonable amount of traffic and revenue. I immediately click the Add to Watchlist Button so I can come back to it later.

PlusModels.com: Looks less interesting based on the low traffic levels and lower revenue. Still, the site has a relatively low Buy it Now (BIN) price, so I’ll add this to the watchlist also, and give it a quick glimpse over later.

bossthemes.co.uk: Could be interesting as a low cost, fixer-upper depending on whether or not you want to have a site targeting the UK. I’m not looking to own a site targeting the UK right now, so I can rule this out.

tensportsclub.com: Looks interesting at first – however, the site ‘claims’ to have $53 in revenue per month – and the BIN is only $299. This seems suspicious to me. I would ordinarily rule this out based on the low BIN compared to the revenue claims – but for the sake of this case study, I will revisit this site later.

aogd.com.au: I don’t even need to look at this site – it’s .com.au, which is a huge pain for non-Australians to register. You basically need a person or a business on the ground in Australia to take ownership of this domain for you – so I can effectively rule this out.

Avengers2Trailer.com: This is a domain that clearly signals to you that the site has an extremely short shelf life. While I’m very much anticipating the 2nd Avengers movie, I don’t think a site that only focuses on trailers of a single movie has any hope of succeeding as long term investment. Really easy to rule out.

As a side note, you’ll occasionally see these kinds of listings on Flippa – I’ve seen stuff like ‘iPhone6ReleaseDate.com’ or ‘SamsungGalaxyS3Review.com’ – while these sites are potentially profitable in the very short term, they’re not worth looking at as investments. They’re called ‘Churn-and-Burn’ projects – essentially short term money grabs. By the time they get listed, the seller has already capitalized on the short term trend and going forward, its unlikely the site will be profitable.

creditscorebooster.com: Another site that I don’t need to look at. The listing states that this is a ‘7 Site Bundle’ – to me, that basically signals to me that this is a bundle of 7 starter sites. While starter sites are sometimes interesting to look at, in this case, the niche is ‘Credit Scores’ which is a highly competitive KW that is nigh impossible to rank for without a lot of SEO knowledge. It’s easy to pass on this one.

forumfusion.net: Basically has no traffic, so I can rule it out immediately.

aussielivingfurniture.com.au: Has the same problem as the .com.au site above – too difficult to get ownership of the domain name. Also, this is a dropshipping site, which is way outside of my expertise, so I’ll pass.

cdcovers.to: I can’t tell what kind of site this is just based on the domain and the description, so I’ll come back to it later on.

treschicdesigns.com: I might give this another look to see if the content is good on this site because the niche seems interesting. If the content/design is good, this could be a starter site fixer-upper type situation. We’ll revisit it.

unbillievable.com: This site, unlike the one above, doesn’t have a clear niche/direction, and has no traffic/earnings, so I can rule it out.

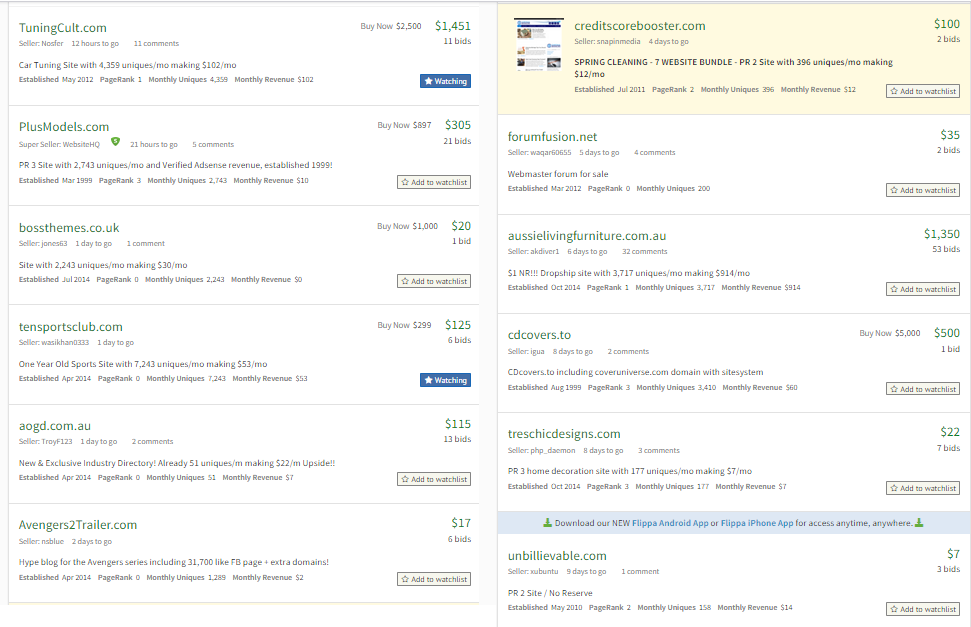

stevemalzberg.com: I have no idea who Steve Malzberg is – the low BIN makes it potentially worth another look, but the domain name is not promising. Domains that have the names of celebrities/famous people on them are generally no good for 2 reasons: 1. It locks you in to a very specific niche that limits site growth, and 2. Sometimes, the person in question can put in a claim for the domain name – if you lose this claim, you can lose your domain with no compensation. The same thing applies to having brand names in your domain.

truthaboutslimming.com: This site is A) about weightloss, which is highly competitive B) appears to have no traffic/earnings and C) uses the words “HUGE Profit Potential!” in the description which are an automatic red flag for me. For these reasons, I’ll pass. In the history of the world, I doubt anything ever described with the words “HUGE Profit Potential!” ever actually produced HUGE Profits of any kind.

playlistway.com: I’m happy to pass on this because A) Music is a difficult niche to make money in, and B) it seems like a technical site, suitable for someone who has some programming ability.

snapchatted.com: Potentially interested in this site based on the huge amount of traffic – on the other hand, the domain contains a brand name, which is a bit iffy for me. Will take a look at it.

Patience, Young Padawan

So, you might be thinking – what was the point of the first half of this case study?

Well, the first thing is that I hope you get some insight into my thought process when glancing through listings. Thus far, there has been no due diligence and no in depth research done. Literally all I did was use a few of the filters available on Flippa. So hopefully, you’ve gotten some useful insight into the first (and easier) half of looking for a site to buy on Flippa.

The second thing that I hope you learn is this: In about an hour or so, I was able to narrow down the number of listings from 3864 listings to 7 listings – without doing any in depth research. Beginners might visit Flippa, a few brokers, and a few other marketplaces, and be overwhelmed with the vast number of websites for sale. The truth is, at any given time, there are probably less than ten websites for sale that: A) Are legitimate and B) Are suitable to your specific needs as an investor. It’s just a matter of finding a set of filters that work for you.

In the Part 2 of this Case Study, I’ll click through to the actual listing pages of all the websites that I haven’t already ruled out. I’ll continue ruling stuff out – and hopefully, I’ll end up with at least one site that I want to find out more about.

Part 2 of the Case Study is Live!